A revenue-neutral carbon tax or fee is a proposed policy to address global warming that's become increasingly popular, particularly in the US. It's a simple concept – put a much needed price on carbon pollution, but return all the revenue that's generated to taxpayers (for example with a monthly refund) to offset rising energy costs. This approach appeals to political conservatives, because it's a free market solution that doesn't increase the size of government.

British Columbia (BC) launched a revenue-neutral carbon fee in 2008, with the tax offset through a matching reduction income taxes. So far it's been very successful, decreasing carbon pollution while the BC economy performed just as well as the rest of Canada's. The carbon tax has 64% support among BC voters.

The main source of opposition to carbon pricing is the perception that it will 'kill jobs' or otherwise hurt the economy. However, economic forecasts have rarely been done for a carbon fee in which 100% the revenue is returned to the taxpayers. Under proposed revenue-neutral carbon tax legislation, about two-thirds of taxpayers are projected to receive more in refunds than they pay in higher energy prices. It's a net financial gain for most people. This is a key factor that differentiates a revenue-neutral carbon tax system and its economic impacts from other carbon pricing systems.

A new study from Regional Economic Models, Inc. (REMI) models this type of policy. REMI has been developing regional forecasting and policy analysis models since 1980. In their study (full report here, summary here), REMI modeled the regional and national economic impacts of a revenue-neutral carbon tax starting at a modest $10 per metric ton of carbon dioxide in 2016, growing steadily by $10 per year each year. They broke the US into nine distinct geographic regions.

A key finding in the study is that personal disposable income would increase under a revenue-neutral carbon tax in every region except for a slight decrease in the fossil fuel-heavy west south central states of Texas, Louisiana, Oklahoma, and Arkansas. This is in large part due to the fact that for most people, their monthly refunds would be larger than the increase in their energy costs. REMI report lead author Scott Nystrom explained the reason for this rise in disposable income,

“Personal income per capita goes up because households receive the total benefit of the dividend as well as improved job opportunities and wages in the general economy, which more than counteracts any negative effects from higher energy and commodity prices.”

The study looked at the impact on the gross domestic and gross regional products (GDP and GRP), and found a positive effect in all regions except for the east south central US (no significant impact), and a negative effect in the west south central states. Overall, the national GDP increases by $80–90 billion annually, with a cumulative increase of over $1.3 trillion. Nystrom explained the GDP increase,

“GDP goes up because the fee and dividend provides a boost to consumer spending, reducing demand for fossil fuels does not have a significant impact on American employment and reduces energy imports from abroad, and the border adjustment means American firms are on a level playing field when it comes to competing on the world market.”

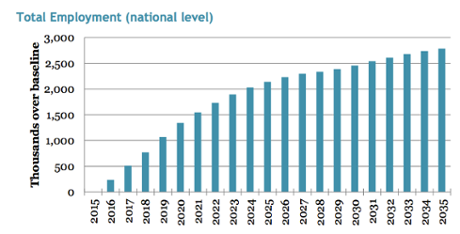

Likewise, total employment is projected to increase in every region except for a slight decrease in those same fossil fuel heavy southern states. Many of the jobs generated are in sectors like healthcare and retail, where people are anticipated to spend their newfound disposable income.

Electricity prices increase for about the first decade due to the carbon pollution price, but then begin to decline as low-carbon energy sources become increasingly cost-effective and widespread. Fossil fuel prices increase steadily as one would expect.

Compared to the baseline scenario without a carbon tax, low-carbon energy sources like wind and nuclear power become a much larger part of the power mix. Coal is anticipated to be phased-out entirely by 2025.

The purpose of the carbon tax is achieved as well, with carbon dioxide pollution projected to decline 33% after only 10 years, and 52% after 20 years, relative to baseline emissions.

In a key side-benefit, because other air pollutant emissions are reduced as fossil fuels are phased out, the report projects that 13,000 premature deaths would be prevented annually after 10 years, with a cumulative 227,000 American lives saved over 20 years.

The REMI report illustrates that we could go a long way towards solving the climate threat by implementing a bipartisan revenue-neutral carbon tax. In the process, most regions would experience job growth, economic growth, more disposable income, cleaner air, better public health, and a less risky climate for future generations.

Groups like Citizens Climate Lobby are working hard to build up grassroots support for this policy. All we need is for a conservative policymaker to step up and take a leadership role to implement this no-brainer win-win of a global warming solution. Republicans strongly dislike the Obama Administration's EPA greenhouse gas regulations; they could easily replace this big government solution with a small government, free market, economically beneficial revenue-neutral carbon tax. Now is the time for conservatives to join the climate policy debate.