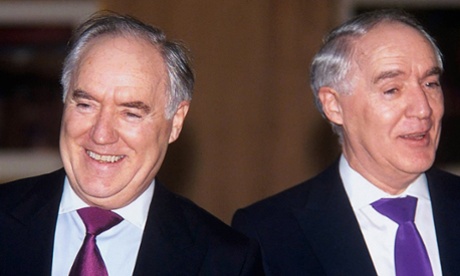

A business owned by the Barclay brothers restructured a £1.25bn debt with assistance from HSBC in the period when their newspaper, the Daily Telegraph, failed to publish a negative story about the bank, the Financial Times reports today.

The paper’s study of financial filings in Jersey by the Barclays’ retail business, Shop Direct, revealed that costs involved in a debt securitisation programme soared by 72% between October 2012 and September 2013 because the main buyer of its notes ran into funding difficulties.

The securitisation programme is crucial to the Shop Direct business owned by Sirs David and Frederick Barclay. It includes Littlewoods and Very.co.uk.

The FT reports that the filing shows that HSBC participated in the programme, starting in 2008, through a special purpose vehicle, Regency Assets. By the time the costs had increased, Regency Assets was purchasing up to £200m of the repackaged loan notes, roughly one-fifth of the total, on a rolling basis.

The timing of the securitisation programme’s increased borrowing costs in 2013 coincided with the period during which Peter Oborne, the Telegraph’s former chief political commentator, alleges that the newspaper avoided, or played down, negative stories about HSBC.

When Oborne resigned last month, he alleged that a November 2012 investigation by the Telegraph into HSBC’s operations in Jersey had been prematurely ended when “lawyers for the Barclay brothers became closely involved”.

He wrote in an OpenDemocracy blogpost that critical stories about the bank were discouraged from the start of 2013, claiming that this was linked to the paper’s advertising contract with HSBC.

He quoted an unnamed former Telegraph executive as saying of the bank it was “the advertiser you literally cannot afford to offend”.

The Telegraph Media Group has strenuously rejected Oborne’s allegations, arguing that it has maintained a distinction between advertising and editorial operations.

The FT article quotes a spokesperson for the Barclay brothers and Shop Direct as saying: “For anyone that understands financial markets or media to think that the editorial decisions of a newspaper can possibly influence the credit committee of a large multinational bank . . . is misguided and just plain wrong.

“Shop Direct’s securitisation programme . . . currently has six large, quality banks, of which HSBC is not the largest lender”.

Source: Financial Times